Introduction

In India, CIBIL score plays a pivotal role in determining an individual’s eligibility for any type of loan in the country. It’s not only a simple score, it basically decides whether the person should get a loan or not. A credit score reflects how a person manages their finances, credit limits given by credit cards and the pattern of repayments of their loans, if any. A good credit score could help individuals to secure fast loan approvals at a lower rate of interest and better opportunities in their financial life. In this blog, this beginner-friendly guide will help many people in their financial journey and help to educate people about the CIBIL score or credit score in detail for maintaining their long-term financial stability.

What Is a CIBIL Score?

It is basically a 3 digit number ranging from 300 to 900 that indicates individual’s or peoples creditworthiness.

Credit worthiness basically reffest the ablity to take loan, credit or borrow money is called as creditworthiness.

It is managed and calculated by India’s leading credit information company, named TransUnion CIBIL. This 3-digit credit score basically determines whether a person or an individual should be granted a loan or a credit card. It tells how a person manages their loans and credit limit in past. Whether it is right to give a loan to a person, all these questions are answered by a 3-digit number called as CIBIL score or a credit score.

CIBIL Score Range

As discussed above in the blog that a credit score is a 3-digit number ranging from 300-900 that basically tells an individual’s creditworthiness. The range of a credit score is as follows:

| Score Range | Meaning |

| 750 – 900 | Excellent |

| 700 – 749 | Good |

| 650 – 699 | Fair |

| 300 – 649 | Poor |

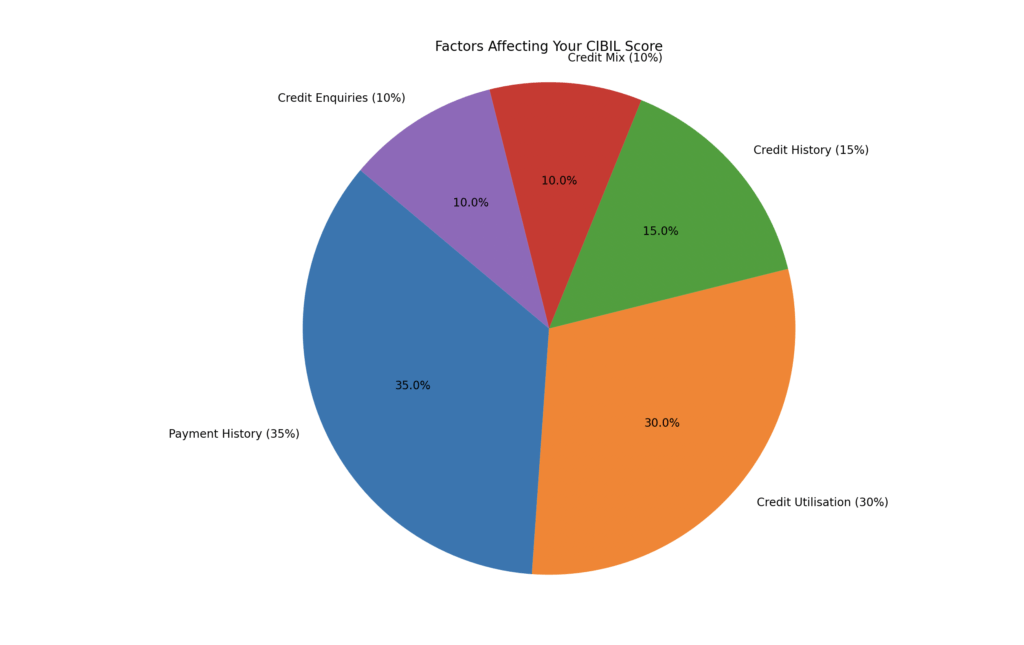

Factors Affecting your CIBIL Score

A credit score is calculated based on the overall credit behaviour of an individual. These histories and reports are being given by the lenders to the CIBIL, and based on that analysis, a CIBIL score is being generated. There are a total of 5 factors which affect the Credit score:

Payment history (35%): It is one of the most important factors that affect credit score adversely, as bad or late repayments could lead to a fall in credit score.

Credit Utilisation (30%): It is the next important factor that affect credit score is the over credit utilization which affects the credit score, directly.

Credit History (15%): It is the most important factor that affects a credit score. The longer the credit history more opportunities for borrowing arrises.

Credit Mix (10%): A balanced mix of credit, which comprises both secured and unsecured loans, improves a person’s credit profile

Credit Enquiries (10%): Every time an individual applies for a credit card or a loan, an enquiry is made. Too many inquiries in a short period negatively affect a person’s credit score.

How to Check CIBIL Score for Free?

Checking an individual’s credit score is very simple and easy in India. As per the new regulation issued by TransUnion CIBIL, an individual could check their credit score once every year through an authorised financial platform.

Step-by-Step Process to Check CIBIL Score.

- Visit the official CIBIL website

- Enter your Pan Card details, date of birth and mobile number

- Verify with an OTP

- Submit the details and get your CIBIL score instantly

My Views

In my view, understanding the importance of a credit score is essential for individuals, students and young professionals in India. Many people only come to know the importance of a credit score after facing rejection from loans or paying a high rate of interest. Treating credit score responsibly, paying the bills on time, and using credit limits offered by credit cards wisely helps you build a healthy credit score and lead a stress-free life.

Conclusion

In this blog, we have understood that a credit score is the key indicator of your financial reliability and plays a crucial role in shaping your access to credit facilities in India. A clear understanding of all the factors associated with a credit score or credit report helps us to make better borrowing decisions in future. So, in the end, it is always advised that developing these habits at an early stage in life improves loan approval chances and strengthens long-term financial stability.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered financial or legal advice. CIBIL score calculations and credit policies may vary over time and across financial institutions. Readers are advised to verify details from official sources, such as TransUnion CIBIL or consult a qualified financial advisor before making any credit-related decisions.